What are municipal taxes like in Lower Mac compared to other areas?

With the recently enacted homestead reduction residential properties assessed under 150,000 in Lower Mac have the lowest municipal property tax bills out of all East Penn communities + Upper Mac. Residents with homes assessed at 111,300 or less are the only remaining homeowners in the entire county who have a local property tax bill of ZERO. (about 1000 households)

Across the board, Lower Mac is tied for the 5th lowest municipal millage rate in all of Lehigh County out of 25 municipalities. Lower Mac’s millage is 50% lower than average for all townships. FYI neighboring Macungie Borough has the lowest municipal taxes out of not just the East Penn Boroughs but all 8 Lehigh County Boroughs.

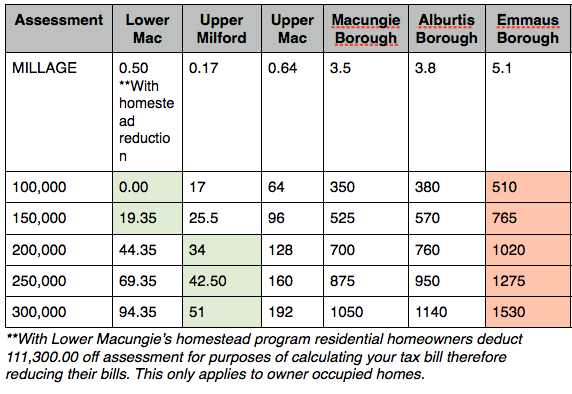

The chart below shows municipal millage rates and the tax bills in dollars for various assessments in East Penn municipalities:

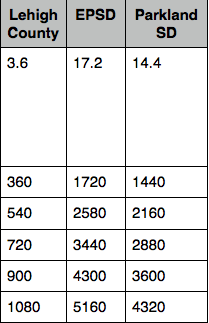

To compare what you pay in municipal taxes vs. what you pay in school property taxes see chart below.

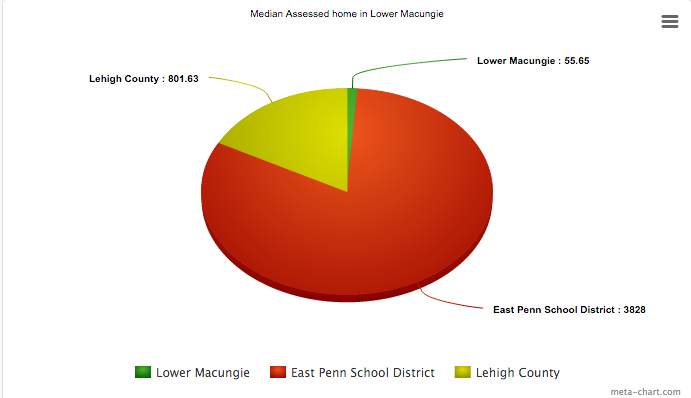

For a home appraised at around 220,000 your Lower Macungie bill represents about 1% of your total property taxes. (See what that looks like below) With the homestead reduction over the last two years 50% of homeowners got a tax break 2 years in a row. 90% got a tax break in at least 1 of the last 2 years.

In Lower Mac we are continuing to fulfill our goal of 1st class services, facilities, parks, amenities and a very aggressive farmland and open space preservation program while keeping municipal taxes very low. Our low millage rate is unparalleled for a township our size with the amount of services and facilities we provide and public works we maintain.