The township Board of Commissioners will be considering the purchase of development rights for the Shepherd Hills golf course in the near future. There have been a number of public meetings where this has been discussed leading up the final decision. Here was the first newspaper article:

New shepherd Hills Golf course owner wants to sell development rights.

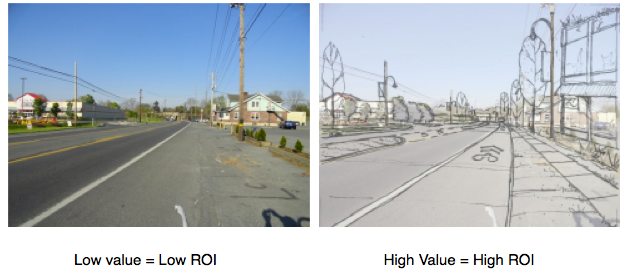

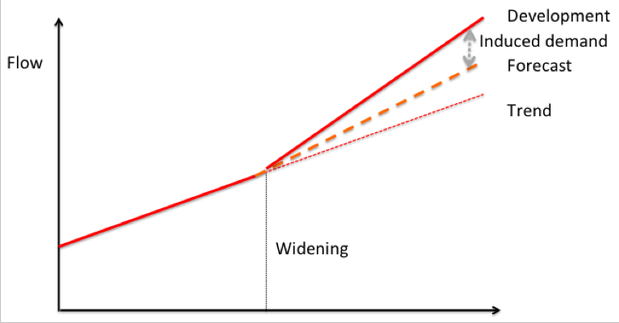

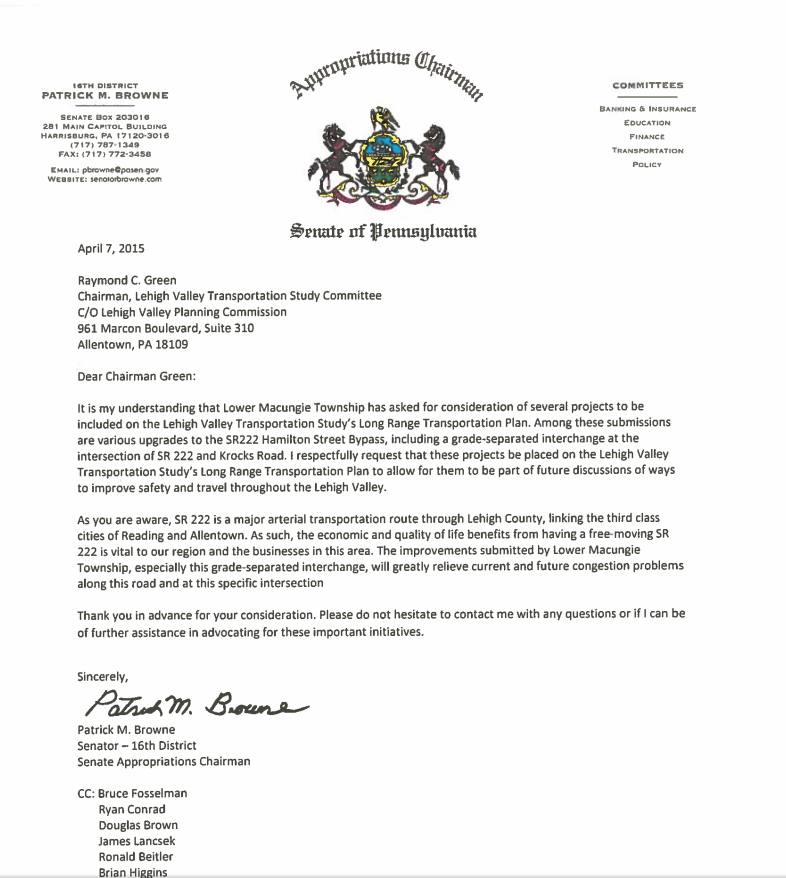

The golf course was identified on the townships official map last year as a target for preservation. This was done after the loss of the Indian Creek Golf course (just one example of many in the Lehigh County) to development. Today, Indian Creek is being developed with 239 homes. To make matters worse it’s a rather uninspiring generic shoehorned plan that will greatly compound traffic issues on an already strained corridor.

What is the official map? With official map, Lower Macungie take proactive stance on land use issues

Link to Lower Macungie Official Map

One of the fairways where homes could be built.

What does purchasing development rights mean?

Purchasing Development Rights is an incentive based, voluntary action that permanently protects open space, yet retains private ownership and in this case golf course management. A landowner sells the development rights of a parcel of land to a public agency, land trust or unit of government. The conservation easement is then recorded and this limits any kind of development permanently. While the right to develop or subdivide that land is permanently eliminated, the land owner retains all other rights and responsibilities associated with the property and the property remains on the tax rolls. The owner also retains ability to sell it should they choose. The protections however, ALWAYS remain. The land can never be developed. In this case it’s similar to the farmland preservation program.

How is the price being determined?

This has been the topic of much discussion. Development rights should be based on market value. Since this involves taxpayer money this is essential. What determines that value is the actual amount of homes that could be built. In this case that’s also assuming the township would grant zero waivers or variances. Which is the assumption since it would almost certainly be the case.

Through appraisals it was determined the price per unit would be 6400 dollars. That is the market value. The initial request assumed the owner could build 145 units. That would mean the cost to preserve development rights would be 930,000 dollars. Upon review by our township engineer it was determined that number was unrealistic. (the plan could not meet the zoning ordinance without relief.)

We felt a more realistic number was 109 units. Which translated to 700,000 dollars. (this was the number in the last newspaper article) However, there was some question relating to a current requirement to only allow one cul-de-sac per development. This requirement was not in place 30 years ago when the original development was built. So the question became what institutes the development. The entirety of Shepherd Hills or the entire new development or each individual parcel (the golf course currently is spread over many separate parcels). With the most township friendly interpretation we further determine 82 units was the most likely amount.

The developer acknowledged but didn’t concede this and further reduced the price to 640,000 dollars. This would correspond to 100 units.

Other concessions agreed upon in addition to permanently preventing 82-109 new homes.

– 100% of preservation money will be re-invested in the course to ensure it remains viable. The township would hold the sale price in an escrow account. Landowner would be limited to debiting the account to make improvements to the course and facilities. Course will provide detailed quarterly accounting of improvements made until all monies are invested. Money would only be released when improvement plans verified.

– If the course closes in addition to permanent development restrictions, the course will be deed restricted to only approved recreational uses.

– The township will acquire an unused portion of the course to replace the Lower Macungie Elementary School Playground with a new pocket park.

– Course will provide public easements to complete greenway connections to and around the neighborhood.

– LMT residents would receive discounted playing fees. Course will be acknowledged as a public private partnership renamed Shepherd Hills Golf Club at Lower Macungie Twp.

My thoughts:

I believe the landowner (who is a developer by trade) wants to continue to operate the golf course. However, he is also a business man. I also know that the golf course and banquet hall are only viable businesses together. We also know this particular developer has developed courses before. (see locust valley) I also know that the impact of even the min amount of 82 houses not necessarily in a walkable location, this close to the Hamilton Corridor and also of the type that would likely generate lots of students in the school district – would present significant strain on the schools, roads and infrastructure. Not to mention the loss of 110 acres of (albeit private) open space in the heart of the twp.

I think we’ve come close to determining the actual market value based on a realistically buildable unit count. This was the sticking point in my mind. Do I want a better bargain? Of course. Always. But I also don’t want to jerk too hard and miss an opportunity to finally put this issue to rest once and for all. That meaning once and for all we know that never will this golf course be developed. That’s the opportunity we now have at a fairly discounted price. After years of intense growth, preservation of open space is a township wide goal. And we have to look to every opportunity to accomplish and take units off the table that whether it be to preserve natural areas, recreation facilities and parks and of course farmland.

One thing to remember is it’s ALWAYS more expensive to preserve property later with our back against the wall than it is to preserve a parcel today with a willing partner. That’s a tough lesson Lower Macungie has learned the hard way with our farmland. Long time residents know that this course was almost developed in 1993. The only thing that stopped it then was a judge ruling favorably on an interpretation. The township then denied a plan and the developer filed a lawsuit challenging.

I’m very interested in what residents think about this issue from now till January when it’s likely to be voted on. You know what I think, now please let me know your thoughts. Email: Ronbeitler@gmail.com

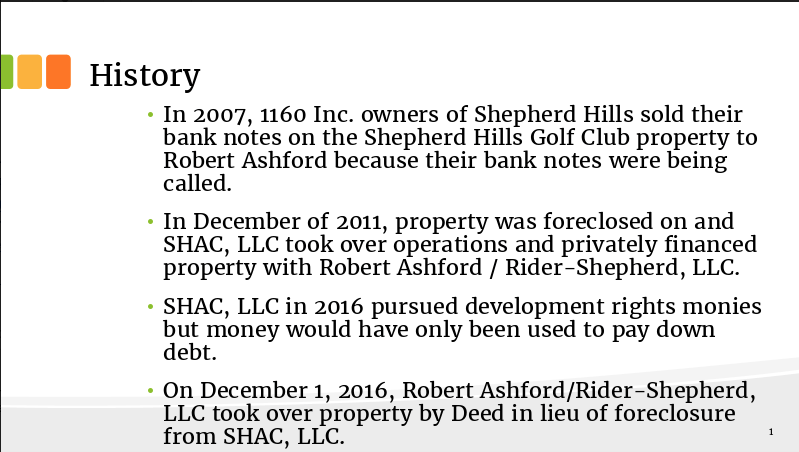

Some history (this is from the developers presentation he sent to us for inclusion in tomorrow’s agenda. The presentation will be publicly available)

Ownership history

Please take a moment to take this survey about your opinion on Shepherd Hills Golf Course. Thank you. Click here.