Proud to be a contributor at a new blog called “Smart Growth for Conservatives“.

“Smart Growth for Conservatives provides analysis of transportation and land use issues from a center-right perspective, with an emphasis on fiscal conservatism and market-based solutions.”

Smart growth is an issue conservatives should rally around. At it’s core it’s a blueprint for building long term fiscally sustainable places. So why has it gotten such a bad rap from some in the conservative movement? I’m going to borrow heavily from some of Jim Bacon’s writing here. It’s largely Jim and Strongtowns Chuck Marohn who really hooked me on the underlying conservative rationale. Conservatives mistakenly equate smart growth with intrusive government intervention in the economy, with regulations, subsidies and boondoggles. Unfortunately, nothing could be further from the truth.

First, while conservative intellectuals are spot-on in their critique of mass transit subsidies, they are blind to subsidies for roads and highways. While they hit the bulls-eye in their critique of land use restrictions, they ignore the systemic subsidies for green-field development. Their critique runs only one way. – Why Conservatives (mistakenly) hate smart growth – Bacons Rebellion

Bacon identifies 4 broad propositions. Here are the problems and reasons conservatives should be concerned.

(1) The pattern and density of development has tremendous impacts on the prosperity, livability and fiscal sustainability of our places.

(2) The post-World War II pattern of disconnected, low-density, suburban-oriented development was largely the result of government interventions in the marketplace at the federal, state and local levels.

(3) That pattern is increasingly dysfunctional, creating congestion and driving up the costs and liabilities of government. (Esp local gov’t!) When up front costs for new development are paid for with transfers of state and federal dollars down to local governments this leads to an illusion of wealth. The problem is when one time windfalls lead to long term liabilities for maintaining the new infrastructure. This exchange — a near-term cash advantage for a long-term financial obligation — is one element of a Ponzi scheme and is the centerpiece of the Strongtowns message. There is no denying we have a ticking time bomb of unfunded liabilities in our communities. We are dealing with this issue in Lower Macungie today.

(4) While many people do prefer auto-oriented communities, there is a pent-up demand for walkable urbanism with access to mass transit.

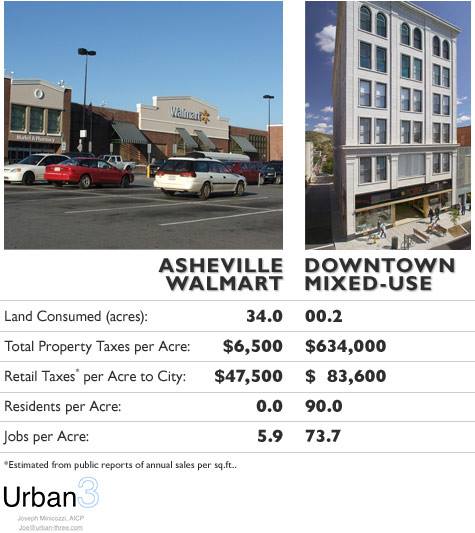

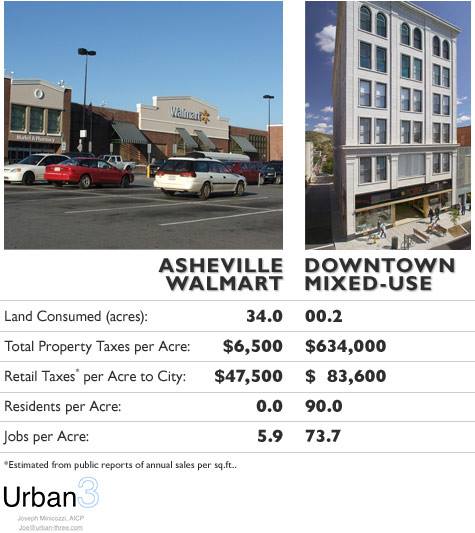

Two patterns of Commercial development. 1. Strip Mall, 2. Traditional Main St.

The traditional Main St. efficiently capitalizes on public investments in while the other is a resource hog consuming a large amount of of land in what should be a towns most financially productive area but what ends up being the least efficient.

So we identified the problems and acknowledge why they are of concern to conservatives. What are the conservative solutions? Here are a few: (and relevance to Lower Macungie in gray)

1. Use the market. Market based open space preservation as a mechanism to keep taxes low. Programs such as Transferable Development Rights. Currently, in LMT we preserve open space primarily with agriculture protected zoning. This is fundamentally unfair to landowners and has failed catastrophically in LMT since it can be overturned by politicians. A TDR program pays landowners for voluntarily severing their development rights by creating a market for density. In a market, the community preserves valuable farmland which in turn keeps taxes low, land owners are fairly compensated for their property and lastly developers are able to purchase density to build in appropriate locations where the gov’t doesn’t need to subsidize their project.

2. Deregulate zoning codes and encourage value capture. We’ve largely regulated ourselves into the our current problems with Euclidean Zoning Codes. The opposite would be a form based zoning code. There will always be a need to separate certain uses. Warehousing is one that comes to mind. Unfortunately here in LMT we’ve allowed a proliferation to an extreme. Warehousing is one example where it’s in the public interest to mitigate impacts with regulations, buffers and costly super-sized infrastructure. But many of the uses we separate with unnecessary regulations don’t have to be if we allow developers to build in the traditional pattern. Think of Main St. Macungie. Here we have residents who live next store to banks, accountants and Doctors. That’s the traditional pattern that worked for hundreds of years. It’s only recently that we steered away from it when we started building isolated pods.

3. Do the math. Perform lifecycle cost and benefit analysis to see if development projects are being subsidized by taxpayers or if they “pay their own way” and indeed generate more revenue then liabilities they create. We’re currently considering subsidizing a massive strip mall project. We assume that it will be a tax benefit. Has anyone actually done the math over multiple life cycles? Sure looks great up front. Shiny new boxes and traffic signals. But what happens when the township has to pay for future improvements and maintenance of infrastructure when the bypass is inevitably so congested that it needs to be widened or we have to build a bypass of the bypass. Shouldn’t we be squeezing every bit of revenue out of our most valuable spaces rather then subsidizing the least efficient pattern? (see photo above)

4. Bottom up government. Build only what we can afford to maintain. As mentioned above top down gov’t distorts what a local municipality can actually afford to build with one time subsidies and windfalls. We need incremental economic development grown organically rather then artificially. We must ensure we can afford to pay for new infrastructure over the long run. (Do the math beyond the windfall) Here in LMT we’ve done a great job of securing millions of dollars in Gov’t grants over the years. I’m not arguing that was bad strategy. We’d be foolish not to seek top down money. But over the years we’ve avoided tough conversations about what happens when that money dries up. This conversation came to a boiling point this past Nov. during the tough tax conversations. We came to the realization that we must account for the long term fiscal sustainability of our township if we want to avoid lump sum huge tax increases in the future.

Interested in learning more? Add www.smartgrowthforconservatives.com to your RSS feed.

About SGFC: Editor Jim Bacon publishes with financial support from Smart Growth America. A life-long journalist, Jim was editor of Virginia Business magazine before launching Bacon’s Rebellion, a blog dedicated to building more prosperous, livable and sustainable communities in Virginia.