Last night after a year of consideration we passed the homestead exclusion ordinance. Here is an overview. I proposed this program in January. After having to do some leg work to get it considered (initially told we couldn’t do it) the board finally adopted the ordinance last night.

One item I wanted to clarify is the program is not a reduction of the millage rate. Some statements made last night could lead people to believe that. It does reduce the tax bills for homeowners it doesn’t for renters, commercial or industrial properties. This is important to understand.

The millage rate in Lower Macungie remains at .33. There was no reduction. What we did was enact a program to lower tax bills of primary residences for those enrolled in the program.

SHORT TERM: With Homestead the reduced bill is based on a reduced assessment. The average Lower Macungie tax bill goes down 19 dollars. This is a good thing. We do our part, the county does it’s part and the school district holds the line. It all does add up. Just like small tax increases over multiple taxing bodies adds up, small overall reductions do also.

I get why some focused on the short term. Framing it as a “tax break“. Politically makes sense for those trying to justify spending 13% of our entire township budget on synthetic fields. But it doesn’t help outline long term benefits. Because focus last night was on short term political narratives the programs long term benefits weren’t explained well. The long term potential is the true value of the homestead exclusion program. To cash in we need to stay focused on that.

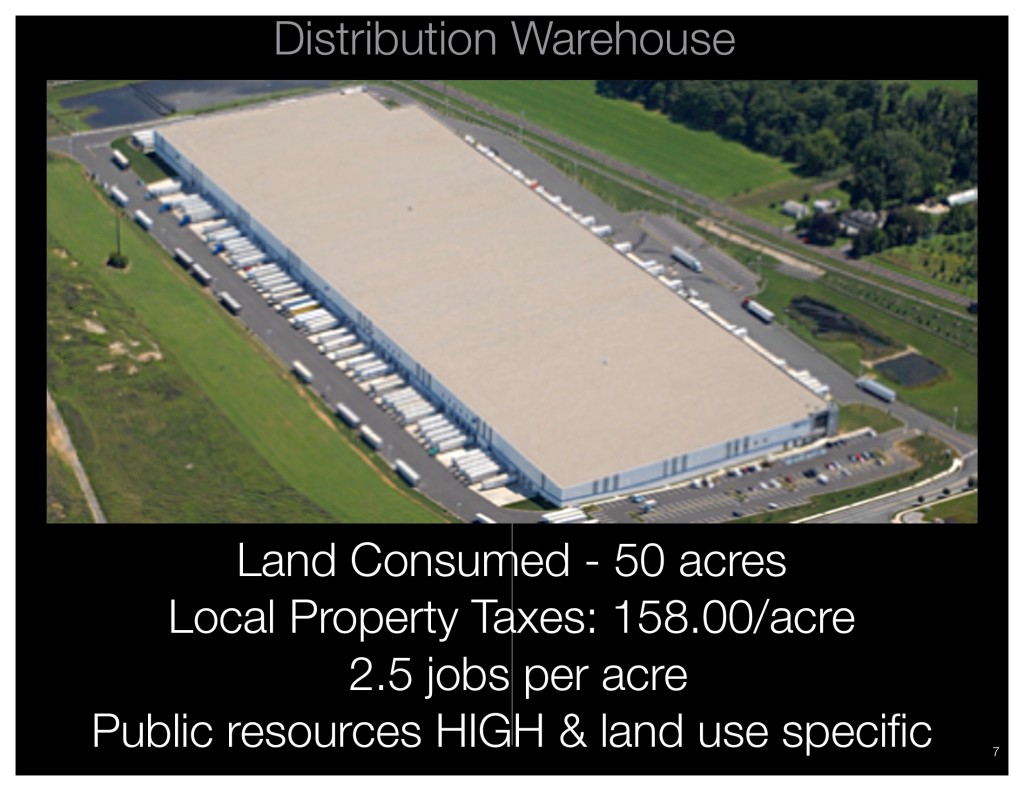

LONG TERM: Long term fiscal sustainability means the township must balance the books. Revenue on the positive side. Liabilities on the negative side. Lower Mac continues to build out strip shopping centers and Industrial warehouse properties. These types of land uses create massive liabilities while generating pound for pound very little in revenue/acre. (see example below) The rezoning of 700 acres of farmland (farmland generates net positive revenue – High ROI) to allow warehouses and strip commercial (Very low ROI) will cost the township more in the long run. The beauty of homestead is that if maxed out it allows us to give a 50% reduction on homeowners tax bill.

As the township balances the books as a result of proliferating low ROI land uses homeowners should not have to pay increased taxes because of dumb growth decisions. To do this we need to:

1. SHORT TERM – Part 1: Adopt homestead exclusion. (We did this last night)

2. LONG TERM – Part 2: Adjust the millage rate and max out the homestead reduction (2015)

With homestead exclusion after we max it out a resident who owns a home in Lower Macungie should always pay a 50% discounted tax bill (via 50% reduced assessment). While we still collect 100% of revenue from industrial and commercial uses.

Residents are intelligent in Lower Macungie. I don’t believe in feeding them talking points. Yes, 19 dollars in your pocket is nice but homestead is a long term play. That’s why I proposed it. Again, I get why some hi-jacked the message and crowed about it last night. Made for a tidy narrative as they tried to justify 3.3 Million in synthetic fields. Great political play. But unfortunately since the program wasn’t really explained in detail the bigger picture benefits were glazed over. This is what’s important. The 19 dollar bill reduction was a bonus. A good thing. But my goal is much bigger. Long term resiliency.

Bottom line: After the one time windfalls of growth is gone the township will eventually need to “balance the books”. Homestead makes sure residential properties aren’t shouldering the burden created by Industrial warehouses and Commercial strip malls.

Distribution warehouses are one of the lowest ROI land uses for a local community.

Warehouses do not generate enough revenue to cover the liabilities they create. This includes increased need for police protection, specialized fire equipment, massive road improvements and general wear and tear, and low ROI per acre of land lost.

To address the long term in 2016 I will propose a full 50% homestead reduction with .50 to .66 mil property tax rate: (the Millage should be increased in conjunction with maxing out the homestead % but more work needs to be done to determine how much)

- Under proposed .66 mil property tax if you own a home at the township average of around 250,000 dollars your tax liability is 165. (Remember, that is local LMT tax not school or County)

- Under a homestead exclusion program that grants a 50% assessment reduction on a primary residence the assessed value (for purposes of tax calculation only) is cut in half to 125,000. Therefore the tax bill is also reduced by half to 82.50. (Current level)

- Meantime Commercial properties such as a distribution warehouses valued at 24,000,000 pays the full assessed value at .66 mil which would be 15,800. This is double the 2014 bill of 7,900.00.

All this is part of a long term plan to address underlying fiscal sustainability. But we have to stay focused. Another part is farmland preservation. Want to lower taxes? Preserve farmland. #saveitorpaveit. Preserving farmland is the number one quality of life issue in the township. By committing to it among many benefits we avoid having to build more infrastructure, provide more services, and we do our part to keep enrollment in EPSD stable.