Clearing out my notebook on the Movie Tavern (Trexler Business Center) – I hope this is helpful for folks to understand why I voted NO. The plan passed 3-2. This one was a long slog. It was unfortunate it turned out that way. It didn’t have to be but certain developer concerns about the impact fe were raised very late in the game.

1.) First, I apologize I wasn’t able to blog more about this topic over the last few months. Problem was for the last few weeks of this issue we were under the implied threat of litigation. Unfortunately, at that point a blog meant to keep residents informed can be used against the township in a court. Once we have the threat or implication of legal action we lose some of our ability to talk freely about a subject. This is unfortunately reality. In cases of land development reviews words can be taken out of context, mischaracterized or misrepresented. I struggle with this. I’m often advised “not to blog so much”, but I fundamentally believe residents should know every piece of information I know. My blog let’s me clearly put my thoughts down “on paper” in writing. The free flow of information is critical to transparency. Unless forced to I’m not inclined to ever compromise that. Hence clearing out the notebook now.

2.) I would have voted yes on the original resolution. The original resolution left a blank space for the amount of credits granted. During the course of consideration 3 credits were agreed upon by the planning and zoning committee and the township engineer and staff. These were negotiated during the course of public meetings. I felt they were fair and I felt they honored the intent of the traffic impact fee by addressing regional issues related to the project. The problem with the resolution presented to us the AM of the vote was that additional credits were granted. These were not subject to public discussion in a meaningful way.

3.) Credits, vs. contributions vs. impact fee monies. The impact fee – “Transportation impact fees are a funding mechanism permitted by the Pennsylvania Municipalities Planning Code (MPC). Fees can be assessed to new development in proportion to its impact on transportation networks—the traffic the development is expected to generate during peak commuter periods. Funds collected are used to improve roadways used by development-related traffic.” PennDOT impact fee guidebook.

That is the purpose. However, I believe the program the way it’s written has some severe flaws. In light of that I am OK with credits to appropriate off site improvements. Using the same definition of off site improvements as the impact fee program. And also gaining the same amount of monetary value as the impact fee program allows. No more, no less. This is very fair and very transparent.

Again, I had no problem with crediting or contributions in liu of impact fee. My problem is we gave additional credits beyond what was agreed upon during the course of public meetings. I also had issues with the credits themselves in that I feel strongly they don’t address issues that would have otherwise been addressed by developers at some point in the future.

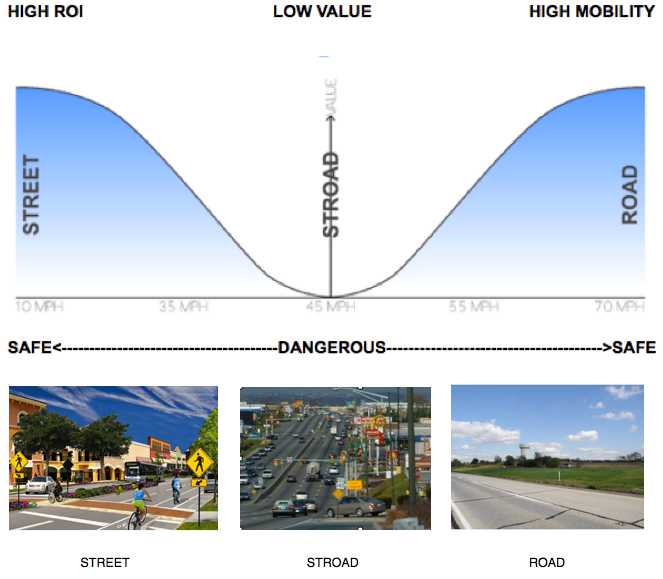

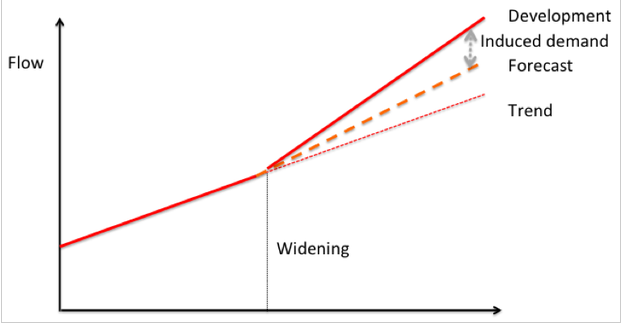

4.) My structural problem with the last minute credits. The last minute credits were basically to fund a new driveway across the street (north side of the blvd.) that will connect Hamilton Blvd and Grange Rd. Now, there are benefits to this and that’s the reason why have it on the township official map. But the map gives us the tools to ensure this conversation happens at an appropriate time. That is in the future when it’s actually needed. (If and when the north side develops, remember the intent of the impact fee is not to address or otherwise induce future development). The problem here is this credit is unrelated to the Movie Tavern project. Further there is no timetable when it ever gets built. And it’s something we would likely secure anyhow based both on our ordinances, the official map and realities of any commercial project built on the north side of the boulevard.

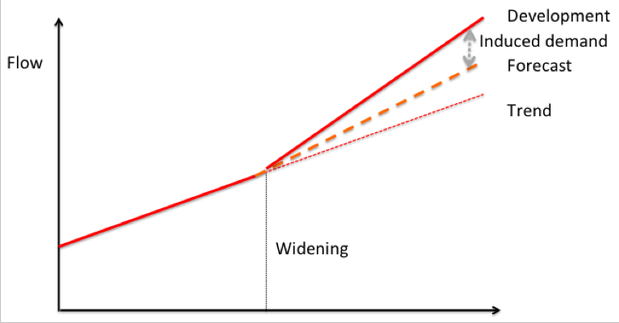

In my opinion, we gave away something that made no sense to do so at this time meaning we left money and value on the table that we should be using to fix existing issues. Not future issues related to more development. I actually believe the townships move last night will expedite and induce more “boxy” development on the north side since it will give future developers more public road frontage. I also question whether the township is obligating ourselves to essentially take ownership of what otherwise would and should be a private shopping center driveway on the north side. If this is the case it’s a strategic error.

5.) Procedural problems with the last minute credits. As mentioned above, there were a number of credits and contributions agreed upon in the course of public meetings. They were presented and vetted in public. They addressed the intent of the traffic impact fee ordinance. I had no problem with this. Issue was, that this still left an approximate 375,000 dollar hole. This hole was “plugged” apparently 24 hours before the final vote. I have an issue with that. So did my father Ronald R. Beitler. The two reasons above including both the structural and procedural issue with the “last minute” credit are why I voted NO on the resolution.

6.) The land development itself is good. I am 100% in favor of preservation and better managing growth. Problem here is this development is proposed in a location identified for growth. Other areas of the township not we are aggressively pursuing preservation strategy. And we’ve had successes. This was not a place that made financial or planning sense to do so.

I do wish this wasn’t another strip and pad project, but for what it is – much like Hamilton Crossings – it’s of a higher quality. I wanted to give specific credit to the Movie Tavern for working with us. They voluntarily upgraded many facets of the plan that will result in a better overall project. They also worked with us on a compromise regarding the tower height. Resident concerns were valid, and the Tavern addressed them. The developer also did work with us during land development although at times we had to push them a little harder. Everything was a negotiation. The Movie Tavern was easier to work with since they understood a better project was better for their business. It was less a negotiation and more working together to build something neat. They seemed to understand the vision we are trying to accomplish on the boulevard. That buy in was important.

7.) The Movie Tavern in and of itself was a good fit. While our job is not to pick winners and losers in terms of uses based on opinions. It is to vet projects based on objective criteria. In this case based on the objective criteria of traffic counts – the Movie Tavern was a much better fit than what otherwise could be built here. The reason is traffic counts generated are off peak. Nights and weekends. Again, the theater will not generate trips during AM or PM peak hours. This was a huge advantage to the township.