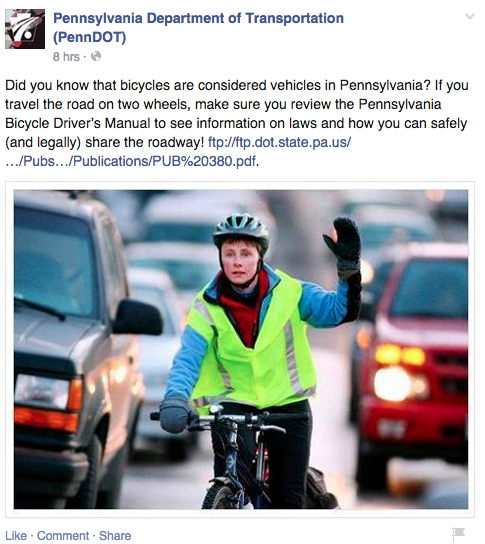

Lots of reaction on social media this morning to this Mcall story posted last night. Here are some initial thoughts and questions.

You can read the report in it’s entirety here. The LVEDC paid around 100k to the Georgia firm “Garner Economics” for the report.

LVEDC Website

First what made the headlines is the report high priority recommendation for a 1 cent sales tax which would generate 33 million a year. LVEDC’s current budget is 2 million. Knee jerk reaction is that this proposed tax increase would create a bloated slush fund for a nebulous board with unelected leadership lacking checks and balances. There were some recent reorganizations of leadership and structure of LVEDC in 2013 and I’d like to learn more about them. But from what I understand decisions in the past were made in private with a public component that was understood to be nothing more then a rubber stamp.

Beyond the big picture issue I took some time reading about what exactly the report outlines be done with 33 million. Some of it is good.

For example, regionalization studies. PA has 2500 individual municipalities and 600 school districts. No other state comes remotely close. This is a big reason why we face some of the statewide problems we do. Here is what the report says:

The Lehigh Valley alone is comprised of two counties and 62 municipalities. The scale of perceived—and, as noted by the taxpayer (businesses interviewed), real—inefficiencies in providing community services is significant. Oftentimes, to a non-resident, there is no separation of lines when traveling from one municipality to another.

No, I am not in favor of forcing individual muni’s to give up local control. As a bottom up government proponent I believe local gov’t to be the most efficient taxing body. Locally a resident can account for every dollar brought in and every dollar spent. A local dollar goes much further then sending your dollar to Harrisburg or Washington to be re-distributed through a broken system. That being said I agree we should conduct studies to identify where compelling cases for consolidation are. Then, if muni’s willingly see the economic and fiscal benefits (in some cases would be a no-brainer) we should make it easy to re-organize.

It’s my understanding Alburtis at one time initiated a study of this subject on it’s own. Remember, Alburtis raised taxes again this year. Macungie raised taxes again this year. Small borough’s often find themselves in tight fiscal jams and their leaders often worry about financial future. This has nothing to do with leadership but everything to do with small size, small population and redundancy of services. Take police protection. In EPSD there are 5 individual police entities operating in one geographic area each with it’s own facilities, union and overhead. I believe in voluntary regionalization and resource sharing initiated from the bottom up.

Another issue cited is the LVIA: I truly have mixed feelings about subsidizing the airport. It is a compelling argument why. The report states:

“Focus group participants and electronic survey respondents noted the need for

additional air service and more affordable rates out of the Lehigh Valley International Airport (ABE).”

Can’t argue with that. But the answer is how do we get there? How do we get a fully operational LVIA? Is the answer more subsidies distributed by another level of bureaucracy? I honestly don’t know.

Lastly here is one example of something that scares me. It deals with infrastructure subsidies. Here is one line:

“Sustainable funding source to allow for mega site development, municipal water

and sewer in more areas of the counties, broadband connectivity in the rural areas, deal closing opportunities, and more.”

This is rural sewer line expansion. That means one thing to me. Sprawl subsidies. More sprawl Industrial complexes paving over cornfields in the outskirts of the valley. More mega strip centers and suburban office complexes. These practices represent the very lowest economic ROI on valuable land. Sprawl subsidies skew the land market. Without subsidies companies will build close to the people who need the jobs and where the infrastructure already exists. Not where the land is justifiably cheap cause it’s in the middle of nowhere.

It boils down to more subsidies for a wildly inefficient development pattern. Sprawl subsidies will encourage local muni’s looking for a quick windfall to build new infrastructure with no accounting on if they can actually afford to maintain it over the long run. After the subisidies dry up and greenfield developers move on to the next field local taxpayers are the ones left holding the bag. We pay for the ongoing improvements and maintenance for projects that were big ole feathers in the caps of local politicians. In many cases unfortunately new liabilities created far exceed the new revenue generated. It then becomes a simple issue of math. Sprawl is financially unsustainable over the long run.

This is definitely something to keep an eye on. I’ll say this sales tax probably has absolutely zero chance of being approved either by Lehigh or Northampton County councils. Def not with their current legislative boards. I do need to learn more about the LVEDC and this study. I’m interested in hearing from folks who have alot more knowledge on this subjec then me. Arguments for and also against. Please feel free to contact me at ronbeitler@gmail.com.

Unfortunately whenever a post like this is made a very small but vocal and extremely uninformed minority of commenters always follows with a litany of silly posts.

Unfortunately whenever a post like this is made a very small but vocal and extremely uninformed minority of commenters always follows with a litany of silly posts.