To demonstrate public value I take different land use patterns and try to quantify.

Parameters include: Public liabilities assumed vs. jobs and revenue created / acre of land lost. Rudimentary but gets us in the ballpark to clearly demonstrate in broad strokes issues with bad land use decisions. I sincerely believe Lower Macungie needs to undertake a sophisticated cost of municipal Services / value study in this same vein to help inform future land use decisions. We must stop chasing growth and start chasing better growth.

Today made a new frame for “Boulevard Commercial”. Relates to my post from Tuesday about the importance of making sure we build out a high quality Boulevard. It’s not only about aesthetics and quality of life but also the financial arguments based on demanding better returns on public dollars. As opposed to strip commercial, Boulevard Commercial returns much higher value.

I think the Progressive Eye Institute is an excellent example. Boulevard Commercial is properly scaled, high quality low impact development along Hamilton. This is what we need to attract in order to avoid the Blvd becoming “Macarther Rd”.

Not only is it better for quality of life and property values but this form of development gives high returns back to the community. Communities making land development decisions need to #dothemath.

Boulevard Commercial. High productivity. Use of existing infrastructure means high value and very low public liability. Focus on high quality means community friendly.

Village Commercial. Highest Value. Utilizes existing infrastructure. Very low community impact and liabilities. Neighborhood friendly.

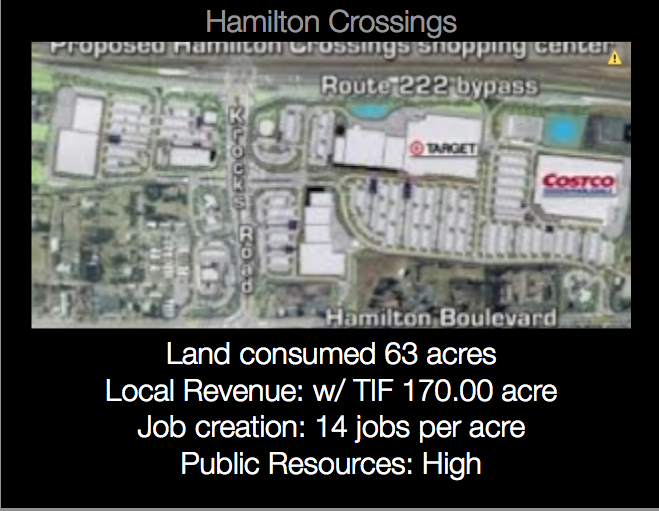

Higher Density strip commercial with high design standards. Better than normal strip commercial because of shared community vision. Will be a better project in Lower Mac than if built somewhere else due to township pressure for quality. Community conscientious developer worked with township to improve project.

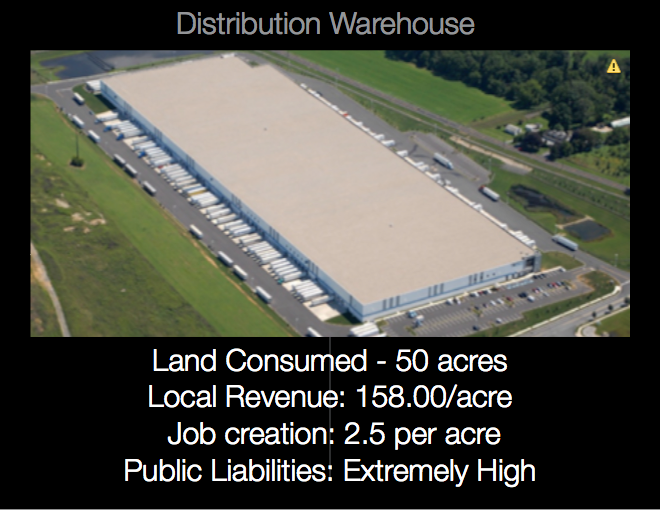

Lowest value revenue and jobs per acre. Ultra high public liabilities. Massive amounts of land lost.

*Warehouse figures close to but before full occupancy. Jobs per acre might be slightly higher now. But even a doubling or tripling of employment still puts this type of development in the extreme low range of productivity paired with ultra high public liabilities.

*Local revenue = assessed value at LMT millage / acreage.

*Public liabilities include consideration for traffic generation, public infrastructure strain and stormwater management costs.