One of the rally cries for fiscal conservatives seeking to look at growth using “smart math” via ROI analysis has been Strongtowns “Taco John” case study.

Recently bloggers from around the country who have been inspired by Strongtowns have been conducting their own “taco john” analyses.

These analyses demonstrate in measurable terms that we have two types of land uses. On one hand land uses that generate positive cash flow and on the other hand ones that gobble up land and fiscal resources at rates that outpace revenue generated. The worse types of land uses do this at alarming clips. When you have too much of the latter as I think Lower Macungie now does leaders will inevitably only have one recourse. Raise taxes…. That is unless we stop and re-think the way we are building out.

An increasing body of evidence very clearly demonstrates sprawl is bankrupting communities that can’t keep up with new liabilities. (The 5 stages of municipal distress)

It boils down to this: There are always two items to consider. 1. New Revenue and 2. New Liabilities. It’s a very basic exercise that is unfortunately rarely conducted on the planning level and one that should be done over multiple life cycles. Well beyond the initial build cycle where rosy forecasting and one time windfalls often paint a misleading picture.

Land owners have property rights. But so do neighbors. Communities are should NOT be obligated to re-zone for uses that will inevitably lead to tax increases. This is the smart math of smart growth. And it MUST be be taken into account when considering zoning.

Below are some Lower Mac cost and benefit examples. I’m preparing a followup post with more local examples and also others from different places including mixed use. Since at this point we really don’t have much mixed use at all. This way we can take a look at some alternatives to status quo we can proactively encourage to better “balance the books”. Years ago Lower Mac once had a commercial problem in that we didn’t have any at all. Problem was and remains that the commercial we’ve built mainly consisting of warehouses and strip malls are some of the lowest ROI land uses. And unfortunately that’s about all we’ve built. And we’ve built it entirely on our most precious resource. Our last few parcels of open space and farmland.

All examples show revenue/acre at Lower Macungie’s .33 millage rate. The same ratios in terms of ROI apply across the taxing spectrum. School, County & Local. School District activists often support “chasing ratables” at all costs. But the flaw of that is the municipal gov’t is left carrying the bag paying the price of sprawl. We can’t rob Peter to pay Paul. The district also need to be a partner focusing efforts on higher value ROI uses. Land is inevitably a finite resource and given we’ve wasted so much on low value uses as we approach build out this becomes more critical.

The Good – Smart Growth PAYS

Commercial land use in the village of East Texas. Converted office building reuse of old home stock. Set in the traditional context this land use generates the highest returns in dollars, the highest jobs per acre and has the least negative impacts and was funded with 0 public dollars. It’s located on shared infrastructure with the rest of the village.

In traditional neighborhood commercial car trips are drastically reduced. Infrastructure is shared and costs therefore drastically reduced. Not only is this the best “bang for our buck” but the investment by the community is relatively small comparable to other less productive land uses. If the township would spend a fraction of what it spends to support less financially productive land uses on our village and neighborhood commercial zones the return in dollars and cents for the township, school and county would be doubled or more.

The Bad

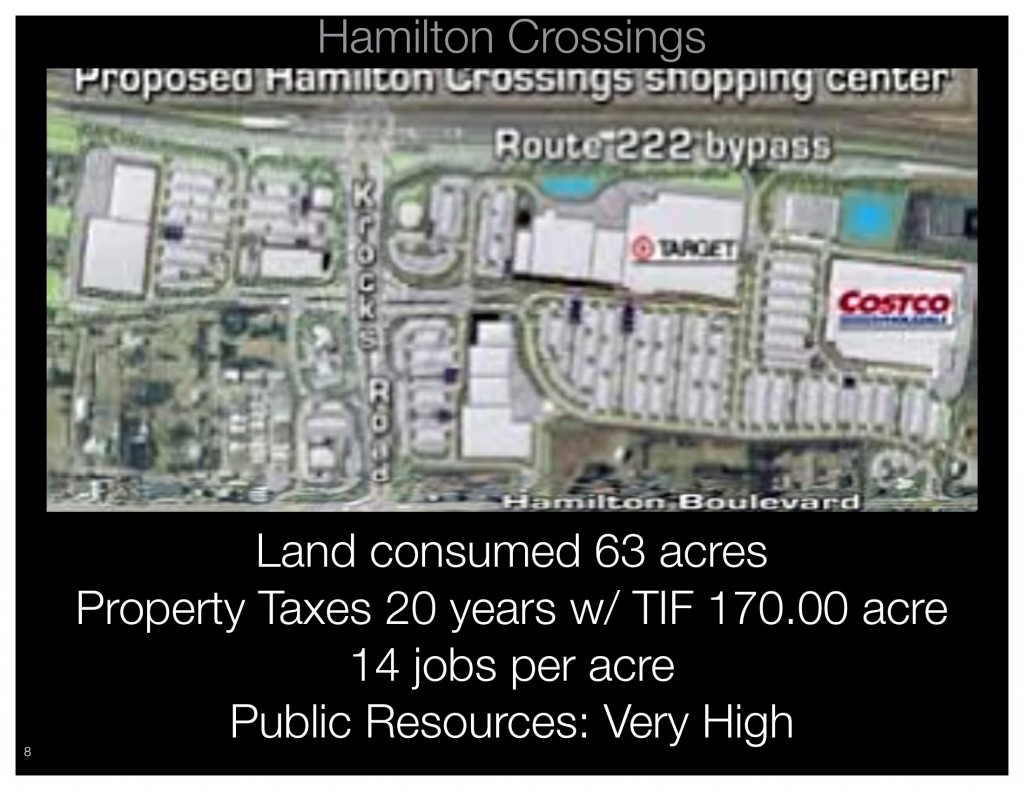

Hamilton Crossings is a strip mall that consumes 60 acres of land. It will produce about 14 jobs per acre upon buildout. (based on TIF narrative.) With the TIF in place for 20 years, the development per acre generates half the revenue as neighborhood Commercial development on a much smaller footprint. As usually is the case with strip developments Hamilton Crossings is also very highly subsidized with state funds to the tune of millions of dollars.

Hamilton Crossings is interesting. Since it’s more dense (due to many dozens of intensity variances granted by Lower Mac) than a typical strip center it’s ROI numbers in terms of dollars aren’t terrible (compared to warehouses which are the worse) except for the fact we granted the project a TIF for 20 years.

So we’re only capturing half that value for a very long time. (I voted in the minority against it) But buyer beware, that density is very much a double edge sword. That density equals supersized traffic. Since it’s not at all walkable most all workers and shoppers will drive. Let’s not kid ourselves about the “sidewalks through parking lots.” This is no promenade. It’s not a walkable destination. Since this project is entirely auto dependent it needs mega-sized infrastructure. To the tune of 13 million dollars.

Supersized traffic + Supersized infrastructure = Supersized bill for taxpayers.

This completely negates the value it creates and the TIF doubles down on that mistake. On top of that it’s a terrible use of land in terms of 14 jobs created per acre. Yes, “900 jobs” sounds wonderful in a projected (likely inflated) TIF narrative. But at what cost?

The Downright UGLY

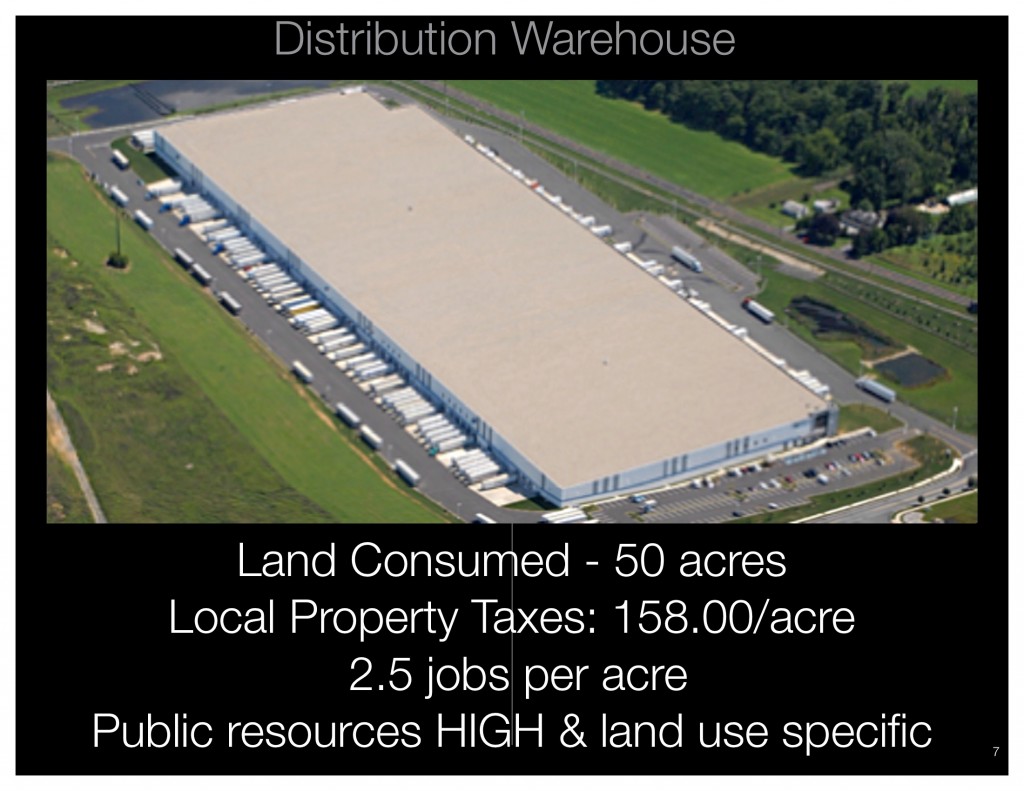

Distribution warehouses built on former farmland. The absolute lowest ROI in all measurable forms. When paired with the highest amount of public resources to maintain (police, fire, supersized infrastructure ect.) this is the the worse type of land use in terms of community benefit. These structures gobble up open space at alarming clips and generate very little benefit per acre. Unless we figure out a way to *assess their impacts, this type of development will cost the township money in the long term.

There is simply no way to around it. Warehouses are our “mega-sized” Taco Johns. They gobble up valuable open space at alarming clips. They produce or make nothing. They employ very few people at very low wages. (and those numbers will continue to dip with new automation techniques until these 50 acre facilities are run by skeleton crews. A dozen people on a shift maybe?) They contribute very little back financially apples to apples compared to what they cost to maintain. They require services such as police and fire. I could go on and on.

Now in our new reality we have to realize we have market forces at work. That yes, we’re strategically located in a place warehouses want to be. And that’s fine. And our zoning ordinance in the 80’s allowed for a limited number of warehouses. But what happened over the years is we’ve overturned our growth boundaries. We’ve doubled and tripled down on warehouses. What was planned to be a limited liability as the township fulfilled it’s legal obligation to provide for it as a land use (A municipality must allow every use somewhere in it’s borders..) now has the potential to cripple us financially.

*Homestead Exclusion one possible way to right size revenue to mitigate the impacts of distribution warehouses.